The multi-currency account is a financial compañero for long travels and is an indispensable part of the globe. Which choice? What are the options? The point with our comparative review

As a traveler, if you decide to go wandering for a few days, to settle in another country several months or if you simply travel on a regular basis, you quickly ask yourself the question of which bank card to buy for the foreigner in order to minimize bank charges on a trip... To avoid unpleasant surprises on site, such as as astronomical bank charges, or refusal to pay certain cards, we will give you here all practical advice on multi-currency accounts and to choose the best online bank!

A multi-currency account, what is it?

One. multi-currency bank account , as its name suggests, it is a bank account available in several currencies. You can then open a main account in euros, and then open “under accounts” in a different currency (interesting when you settle in a country for some time). The advantage is that these multi-currency accounts do not impose commissions and operate with the real exchange rate. A multi-currency bank account also makes it possible to obtain a bank card to travel: withdrawal fees and non-euro payments are generally very advantageous.

Today there are several multi-currency bank accounts on the market. So here's one. table comparative a selection of online bank, which will each be detailed through this article, in order to best guide you for your future trips!

[object Promise]

* Outside Euro Area

N26

N26 is a German online bank, founded in 2013 by Valentin Stalf and Maximilian Tayenthal. Fully designed for mobile, N26 is a really simple, pleasant and easy to use bank.

N26 offers 2 interesting accounts for travellers: N26 (total free) and N26 Black (9,90€). For the 2, card payments out of the euro zone are free of charge, and withdrawals out of the euro zone cost only 1.70% of the amount of the transaction with N26, and are free with N26 Black. The most? No withdrawals or payments limit, and travel insurance and assistance included (with N26 Black), N26 is really ideal for travellers!

We love :

-

The simple and intuitive mobile app

-

Payments by card outside euro zone free of charge

-

No withdrawal or payment limit

-

Travel insurance included with N26Black

We love less :

- Limited to 5 free withdrawals per month in euro area (additional withdrawal 2 €)

This map is ideal for travel, in combination with a “normal” bank card for France. We recommend N26 Black for a world tour and N26 for shorter trips.

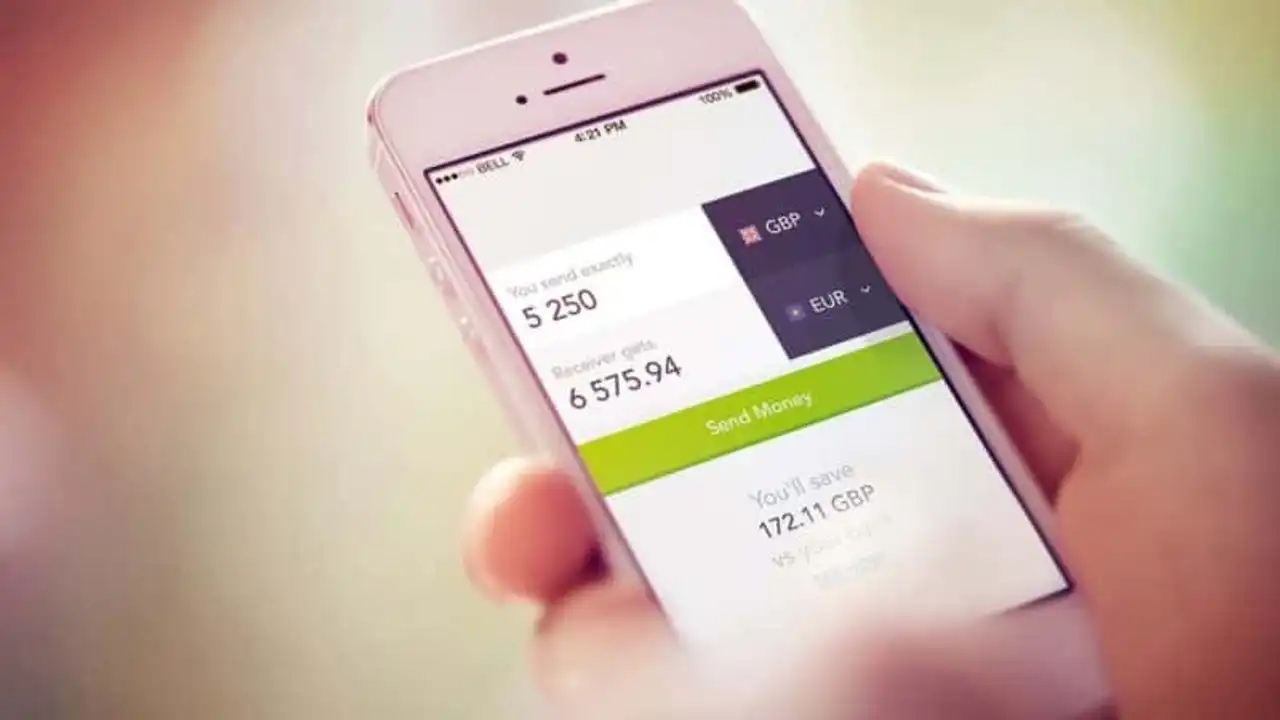

Transferwise

TransferWise is an international money transfer company launched in January 2011 by two Estonians, Kristo Käärmann and Taavet Hinrikus. This bank allows you to send money abroad at the lowest possible cost by using only real exchange rates and transparent fees.

mastercard offered allows you withdrawals outside the euro zone free of charge, but card payments are paid (although the fees are low). More than a bank for the trip, we recommend TransferWise if you leave to settle for some time in another country, or if you have to work regularly abroad.

We love :

- Actual average exchange rates

- Minimal cost transfer fees and charged in full transparency

- Free Euro off-area withdrawals

We love less :

- The limited number of countries supported

- Payments by card are paid (between 0.35%-2%)

ING Direct

ING Direct is one of the best known online banks! It offers a single bank card, but not the least, since it is the Mastercard Gold . This bank is therefore interesting because it offers a high-end oriented offer with this Gold card while being hyper accessible (abs bank rate and offers without income conditions)

We love :

- Free account opening

- 80 euros when creating an account

- Get the Gold Mastercard® Gartage that protects you while travelling to France and abroad

We love less :

- Mandatory monthly payment

With an account at ING, you have the assurance that you can pay with your bank card anywhere! It is therefore an ideal main and/or complementary bank for the traveler, having at disposal all the high-end aspect related to the possession of a Mastercard Gold.

Boursorama

Boursorama Bank is one of the oldest online banks in the market. She is often described as the cheapest bank, which is worth her undeniable success! The bank’s niche is therefore focused on competitive prices associated with a wide range of products, like what is found in a physical bank.

However, their travel offer is not the most attractive. Costs are generated for each withdrawal or payment outside the euro zone. Despite travel insurance included, this bank is not really ideal for travellers.

We love :

- Travel insurance included

- 80€ welcome offer for any opening

- Free banking card

We love less :

- Several cases of card blockage abroad

- 2% commission for withdrawal or payment

Revolut

Revolut was created in 2015 in London by Nikolay Storonsky and Vlad Yatsenko, This bank is very interesting for travellers because it does not take any commission on payments and withdrawals abroad.

Two accounts are proposed: one standard standard and one premium premium premium premium . The premium is paid (7.99 € / month), while the standard is free. But with the premium, the withdrawal and payment fees are free up to €400 per month, while with the standard account you are only entitled to €200/month. One repatriation insurance is also included with the premium account.

In short, a standard account (so completely free) is ideal for short stays abroad. If you travel a little longer, the premium account that provides higher ceilings may be more convenient.

We love :

- Free account opening

- Payment and withdrawal without commission (with ceiling)

- The repatriation insurance included in the premium account

We love less :

- The application is only available in English

- Depth up to €200 per month to the distributor without charge for the standard account

Ferratum Bank

Ferratum Bank is a bank based in Europe, 100% online, with a customer service in French. Account opening is online and free and among its offers, Ferratum Bank offers a multi-debit account.

For travellers, this bank is interesting, because in addition to being free, there is no no fees on withdrawals and non-euro zone payments!

We love :

- Withdrawal to free DAB, within 4 per month (foreign)

- Free transfers

- Free credit card payments

- European multi-debit account

We love less :

- No travel insurance

To make sure you make the right choice of your online bank when you are a great traveler, it is therefore essential to analyze the different key criteria in this file. And you, what online bank do you use, and why?

Loading comments ...